No Tax on Tips Passes Senate: What It Means for You and the Future of Worker Compensation

The Senate’s recent passage of legislation exempting tips from federal income tax has sent ripples through the service industry and beyond. This landmark decision, while seemingly straightforward, has far-reaching implications for workers, businesses, and the overall tax system. This article delves into the details of the bill, analyzes its potential effects, and explores the ongoing debate surrounding its long-term consequences.

Understanding the Implications of the Tip Tax Exemption

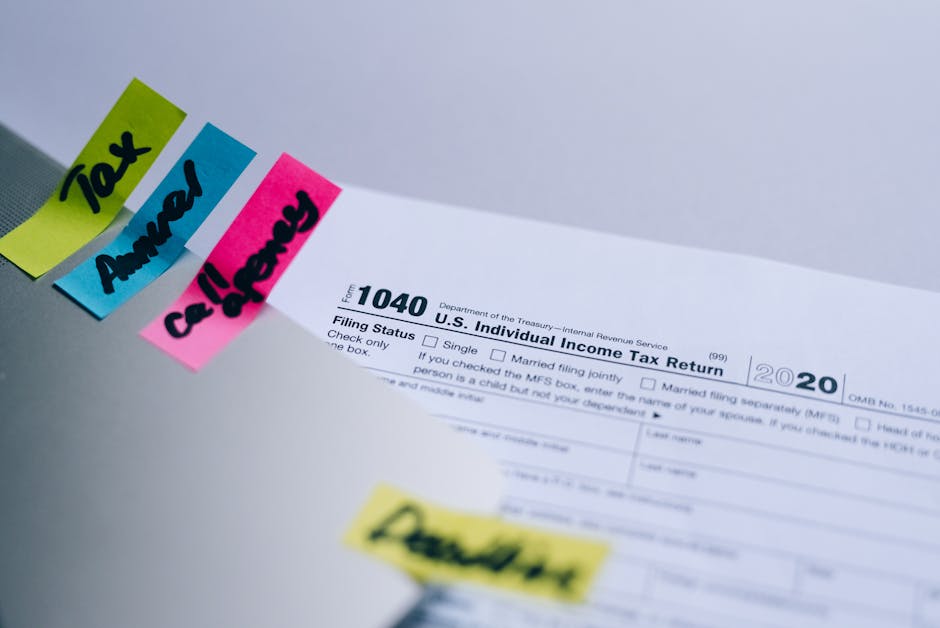

For years, tipped employees have faced the complexities of reporting and paying taxes on their tips. This often involved meticulous record-keeping, potential discrepancies between reported and actual earnings, and the added burden of managing a potentially fluctuating income stream. The new legislation aims to simplify this process by eliminating the federal income tax on tips altogether. This means tipped workers will keep a larger portion of their earned income, potentially leading to increased disposable income and improved financial stability.

Who Benefits Most?

The most immediate beneficiaries are, unsurprisingly, tipped workers themselves. This includes servers in restaurants, bartenders, hair stylists, taxi drivers, and other service industry professionals who rely heavily on tips to supplement their base wages. The impact will be especially significant for low-wage earners who often struggle to make ends meet. However, the indirect benefits might extend to businesses as well. Increased disposable income for employees could lead to increased consumer spending, potentially stimulating economic growth in the affected sectors.

Potential Drawbacks and Concerns

While the benefits are clear, some concerns have been raised regarding the long-term fiscal impact of this legislation. Critics argue that the loss of tax revenue from tips could create a budget shortfall and necessitate cuts in other areas. Furthermore, the potential for abuse and inaccurate reporting remains a concern. Ensuring compliance and preventing tax evasion will require robust enforcement mechanisms. The potential for increased payroll taxes or other adjustments to compensate for lost revenue needs further consideration.

The Legislative Journey: From Proposal to Senate Approval

The bill’s journey through the legislative process was not without its challenges. It faced scrutiny from various groups, including those concerned about the potential financial implications and those advocating for alternative approaches to supporting low-wage workers. The debate highlighted the complexities of balancing the needs of workers with the broader fiscal health of the nation. The eventual Senate approval underscores the growing recognition of the need to address the unique challenges faced by tipped employees.

Key Arguments in the Debate

- Proponents argued that the tax exemption would directly benefit low-income workers, boost their morale, and improve their standard of living. They emphasized the unfairness of taxing tips, which are often unpredictable and already subject to significant deductions for credit card processing fees.

- Opponents raised concerns about the potential loss of tax revenue and the need for responsible fiscal management. They also argued that other measures, such as raising the minimum wage or providing targeted tax credits, might be more effective and equitable ways to support low-wage workers.

The Future of Worker Compensation and the Tax System

The passage of this legislation marks a significant step in the ongoing conversation about worker compensation and tax policy. It signifies a growing awareness of the unique challenges faced by tipped employees and a willingness to explore alternative approaches to taxation. This decision sets a precedent, potentially influencing future discussions about taxation and its impact on different segments of the workforce.

Long-Term Effects and Future Legislation

The long-term effects of the tip tax exemption will require careful monitoring and analysis. Data on worker income, consumer spending, and government revenue will be crucial in assessing its success. It is likely to spur further debate on related issues, such as the minimum wage, the role of tips in compensation structures, and the broader fairness of the tax system. Further legislation might be necessary to address unforeseen consequences or to refine the existing framework.

Practical Implications for Tipped Employees

For tipped employees, the immediate impact is likely to be a welcome increase in take-home pay. However, it’s crucial to understand that this does not eliminate all taxes. State and local taxes on tips may still apply. It’s essential to consult with a tax professional or utilize reliable tax software to ensure accurate filing and compliance with all relevant regulations. Accurate record-keeping remains important to avoid potential issues.

Navigating the New Landscape

- Keep detailed records of all tips received, regardless of payment method.

- Consult a tax professional to ensure accurate filing and compliance with all relevant state and local tax laws.

- Stay informed about any changes or updates to tax regulations related to tips.

- Understand your employer’s responsibilities regarding tip reporting and payroll.

Conclusion: A Step Towards Fairer Compensation?

The Senate’s decision to eliminate the federal income tax on tips represents a significant shift in how the government addresses the compensation of tipped workers. While the long-term implications require careful monitoring, the immediate impact is likely to be positive for millions of service industry employees. This legislative action could serve as a catalyst for further reforms aimed at creating a more equitable and sustainable system of worker compensation, potentially influencing policy discussions for years to come. The future will reveal whether this measure proves a truly effective solution or merely a first step in a longer, more complex process of reforming compensation and tax policy.