Decoding the Senate Tax on Tips: A Comprehensive Guide for Employees and Employers

The taxation of tips, especially as it relates to Senate actions and potential legislative changes, is a complex area that often leaves both employees and employers feeling confused. This comprehensive guide aims to clarify the intricacies of tip taxation, focusing on the role of the Senate, potential legislative impacts, and the best practices for compliance. We’ll explore the federal regulations, state-level variations, and common misconceptions surrounding this often-overlooked aspect of payroll and tax compliance.

Understanding the Basics of Tip Taxation

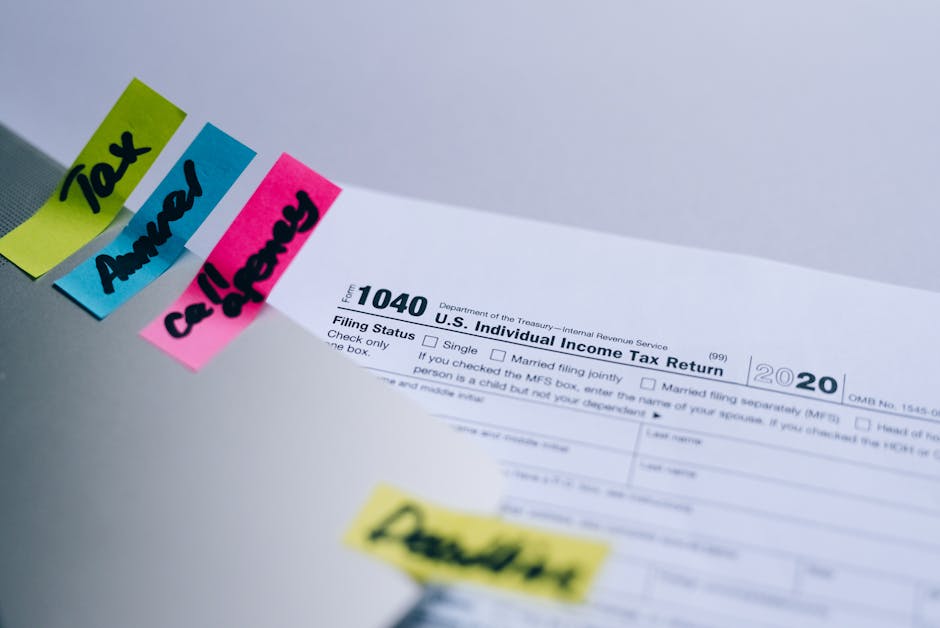

In the United States, tips received by employees are considered taxable income, just like wages and salaries. The Internal Revenue Service (IRS) mandates that all tips, regardless of their source (cash, credit card, or other means), must be reported to the employer and included in the employee’s total income for tax purposes. This means that both the employee and the employer have responsibilities in accurately reporting and paying taxes on tips.

Employee Responsibilities Regarding Tip Reporting

- Accurate Tip Reporting: Employees are legally obligated to report all tips received, even those not reported through credit card payments. Underreporting can lead to significant penalties and back taxes.

- Tip Record Keeping: Maintaining detailed records of all tips received is crucial for accurate reporting. This includes keeping copies of credit card receipts, daily logs, or any other documentation that proves the amount of tips earned.

- Employer Reporting: Employees must inform their employers of their tip income, usually through a designated tip reporting form or system.

- Filing Taxes: Tip income must be included on the employee’s personal income tax return, along with other sources of income.

Employer Responsibilities Regarding Tip Reporting

- Tip Reporting System: Employers must have a system in place to track and report tip income, often using a combination of employee reporting and credit card processing data.

- Payroll Tax Withholding: Employers are required to withhold income tax and FICA (Social Security and Medicare) taxes from the reported tip income, just as they would with regular wages.

- Accurate Reporting to the IRS: Employers must accurately report all employee tip income to the IRS through various payroll tax forms.

- Tip Credit: In certain circumstances, employers may be eligible for a tip credit to offset the cost of paying employment taxes on tips. However, this is only available if the employer meets specific requirements.

The Senate’s Role in Tip Taxation

While the fundamental rules of tip taxation are largely established at the federal level by the IRS, the Senate plays a significant role in shaping tax laws that impact tip reporting and compliance. The Senate can initiate and pass legislation that affects:

- Tax Rates: Changes in federal income tax rates directly influence the amount of tax owed on tip income.

- Tax Credits and Deductions: The Senate can create or modify tax credits and deductions that may affect the tax burden on tip earners or employers.

- Enforcement and Penalties: Legislation passed by the Senate can strengthen or weaken IRS enforcement of tip reporting regulations, influencing the penalties for non-compliance.

- Reporting Requirements: The Senate has the power to change or clarify the requirements for reporting tips, impacting both employees and employers.

State-Level Variations in Tip Taxation

It’s crucial to understand that tip taxation isn’t solely governed by federal laws. Many states have their own regulations regarding tip reporting and taxation, which can add layers of complexity. These variations can include different state income tax rates, specific reporting requirements, and unique enforcement mechanisms. Businesses operating in multiple states must navigate a patchwork of different regulations, requiring meticulous attention to detail.

Common Misconceptions about Tip Taxation

Several misconceptions surround tip taxation, leading to potential errors and compliance issues. Let’s address some of the most common:

- Myth 1: Only Cash Tips Need to be Reported: All tips, regardless of payment method (cash, credit, or other), must be reported.

- Myth 2: Employers Don’t Need to Track Tips: Employers are legally responsible for tracking and reporting employee tip income.

- Myth 3: Tip Income is Always Taxed at a Lower Rate: Tip income is taxed at the same rate as other forms of income, based on the employee’s overall income bracket.

- Myth 4: Small Amounts of Tips Can Be Ignored: All tips, no matter how small, should be reported to avoid potential penalties.

Best Practices for Tip Tax Compliance

Both employees and employers can take steps to ensure compliance with tip tax regulations:

For Employees:

- Keep meticulous records of all tips received.

- Report tips accurately and promptly to your employer.

- Understand your state and federal tax obligations.

- Consult with a tax professional if needed.

For Employers:

- Implement a robust tip reporting system.

- Provide training to employees on tip reporting procedures.

- Stay updated on changes in federal and state tip tax regulations.

- Consult with a tax professional or payroll specialist.

Conclusion

The taxation of tips is a vital aspect of employment and tax law. While it can be intricate, understanding the basics, the role of the Senate in shaping relevant legislation, and best practices for compliance is crucial for both employees and employers. By staying informed and proactive, individuals and businesses can avoid potential penalties and ensure accurate reporting of tip income.