Decoding the No Tax On Tips Act: A Comprehensive Guide for Employees and Employers

The taxation of tips in the United States is a complex area, often riddled with misconceptions. While there isn’t a singular, official act titled “No Tax On Tips Act,” the term frequently appears in discussions surrounding proposed legislation or the misunderstanding of existing tax laws concerning tips. This comprehensive guide clarifies the current state of tip taxation, addressing common myths and providing a detailed explanation for both employees and employers.

Understanding Tip Taxation in the US

Tips, or gratuities, are considered taxable income by the Internal Revenue Service (IRS). This means that both employees and employers have responsibilities regarding the reporting and taxation of tips. The actual application of this rule, however, can be quite nuanced. Let’s delve deeper into the specifics.

Employee Responsibilities: Reporting and Paying Taxes on Tips

Employees receiving tips are legally obligated to report all tips received, regardless of whether they are reported directly to the employer or received in cash. This includes tips received directly from customers, as well as tips pooled and shared amongst service staff. Accurate reporting is crucial for avoiding penalties and potential legal ramifications.

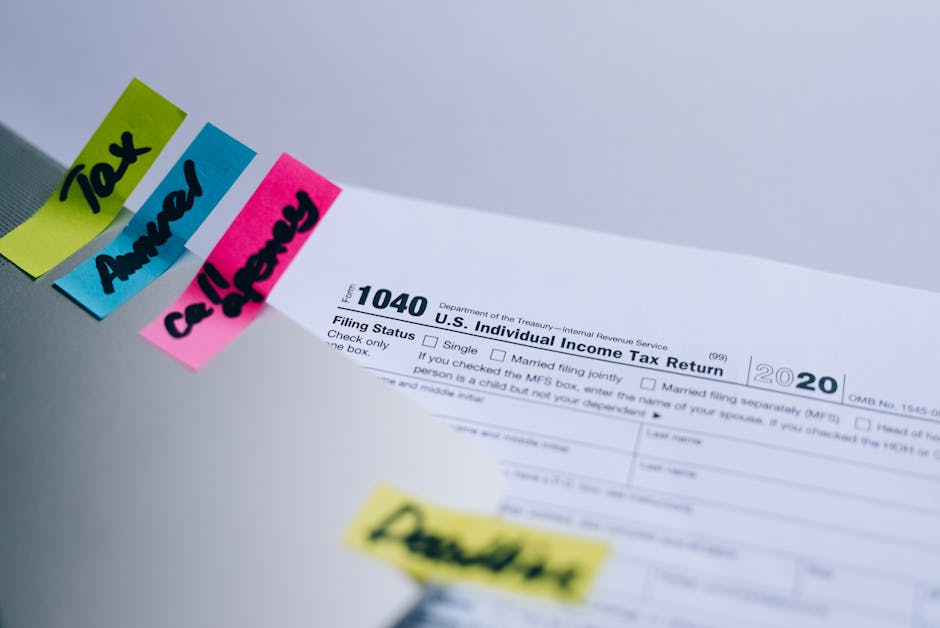

- Form W-2: Employers often report a portion of tips received on employee W-2 forms, usually based on reported or observed tip amounts. However, this is only a portion of the liability.

- Form 1040: Employees must report all tips received on their personal income tax return (Form 1040), Schedule C (Profit or Loss from Business), or Schedule SE (Self-Employment Tax) if they are self-employed.

- Form 4137: If tips exceed a certain threshold, employees might be required to file Form 4137, Social Security and Medicare Tax on Unreported Tip Income.

- Employer Reporting: Employers often provide employees with a statement of reported tips, which can help reconcile the amount reported with the actual tips earned.

Employer Responsibilities: Reporting and Withholding Taxes on Tips

Employers also have responsibilities when it comes to tips. While they don’t directly tax the tips themselves, their role is vital in the reporting and withholding processes.

- Tip Reporting Requirements: Employers are required to maintain accurate records of reported tips and ensure proper reconciliation with employee reports. They may use various methods, including tip reporting systems and employee self-reporting forms.

- Withholding Taxes: Employers are obligated to withhold income tax, Social Security tax, and Medicare tax from employee wages, including the portion of tips reported. Failure to do so can result in penalties.

- Payroll Reporting: Employers must accurately report all tip information to the IRS through various payroll tax forms. Accurate reporting ensures compliance and avoids potential audits.

Addressing the Myth of a “No Tax On Tips Act”

The notion of a “No Tax On Tips Act” is a misconception. There is no federal law that exempts tips from taxation. Proposals for tax reforms or changes in tip reporting practices may occasionally surface, but no legislation has been enacted to eliminate the taxation of tips.

The confusion likely stems from several factors, including:

- Misunderstanding of Tax Laws: Many individuals misunderstand the intricacies of tip reporting and taxation, leading to the belief that tips aren’t taxable.

- Variations in State Laws: State laws regarding tip taxation may vary slightly, further adding to the complexity and potentially contributing to the misconception.

- Advocacy Groups: Some groups advocate for changes to tip taxation, potentially fueling the misconception that a “No Tax On Tips Act” exists or is being pursued.

Consequences of Non-Compliance

Failure to properly report and pay taxes on tips can have severe consequences for both employees and employers.

- Penalties and Fines: The IRS imposes significant penalties and fines for failing to report tips accurately. These penalties can include back taxes, interest charges, and additional fines.

- Legal Action: In severe cases, non-compliance can lead to legal action, including audits, investigations, and even criminal charges.

- Reputational Damage: For employers, non-compliance can damage their reputation and affect their ability to attract and retain employees.

Frequently Asked Questions (FAQs)

Q: Are cash tips taxable?

A: Yes, all tips, including cash tips, are taxable income and must be reported.

Q: What if I don’t know the exact amount of tips I received?

A: You should make a reasonable estimate based on your best recollection. Keeping a detailed record of your tips can significantly assist in accurate reporting.

Q: Are tips included in my gross income?

A: Yes, tips are included in your gross income and are subject to income tax, Social Security tax, and Medicare tax.

Q: Can my employer deduct tip income from my paycheck?

A: No, your employer cannot deduct tip income from your paycheck. The employer’s responsibility is to withhold taxes from your reported wages, including your reported tips.

Q: What happens if my employer doesn’t report my tips?

A: You are still responsible for reporting your tips to the IRS. You should keep detailed records of your tips to prove your income. You should also report the employer’s failure to report your tips to the IRS.

Conclusion

While the idea of a “No Tax On Tips Act” is inaccurate, understanding the intricacies of tip taxation is vital for both employees and employers. Accurate reporting and compliance with IRS regulations are essential to avoid penalties and ensure smooth tax compliance. This guide provides a comprehensive overview, but consulting with a tax professional is always recommended for personalized advice.